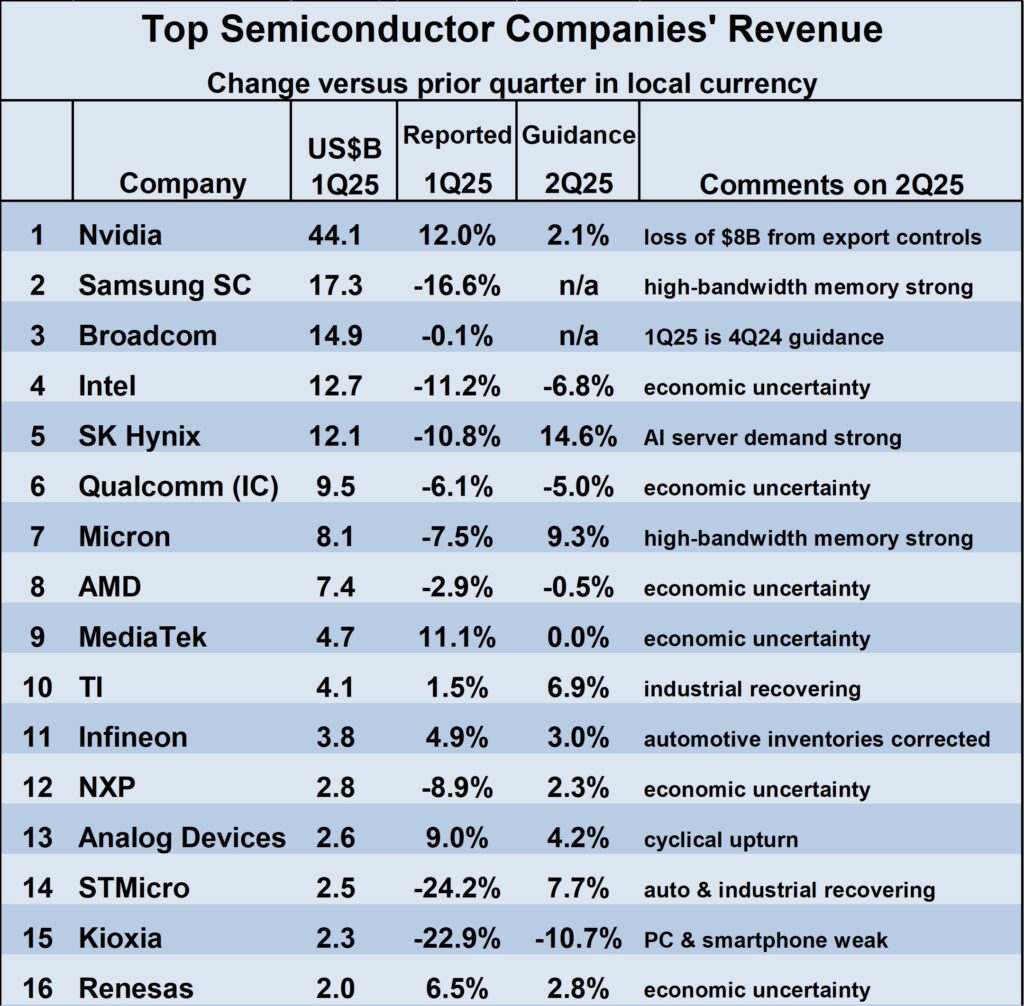

WSTS reported 1st quarter 2025 semiconductor market revenues of $167.7 billion, up 18.8% from a year earlier and down 2.8% from the prior quarter. The first quarter of 2025 was weak for most major semiconductor companies. Ten of the sixteen companies in the table below had declines in revenue versus 4Q 2024, ranging from -0.1% from Broadcom to declines of over 20% from STMicroelectronics and Kioxia. Six companies reported revenue increases, ranging from 1.5% from Texas Instruments to 12% from Nvidia. The outlook for 2Q 2025 is mixed. Nine of the fourteen companies providing guidance expect revenue growth in 2Q 2025 from 1Q 2025, with the highest from SK Hynix at 14.6%. MediaTek expects flat revenue. Four companies are expecting revenue declines, with the largest from Kioxia with a 10.7% decline.

In their conference calls with analysts, most of the companies cited economic uncertainty due to tariffs as a factor in their outlook. Companies dependent on the automotive and industrial markets are seeing recoveries. Strong AI demand is driving growth at Nvidia and the memory companies.

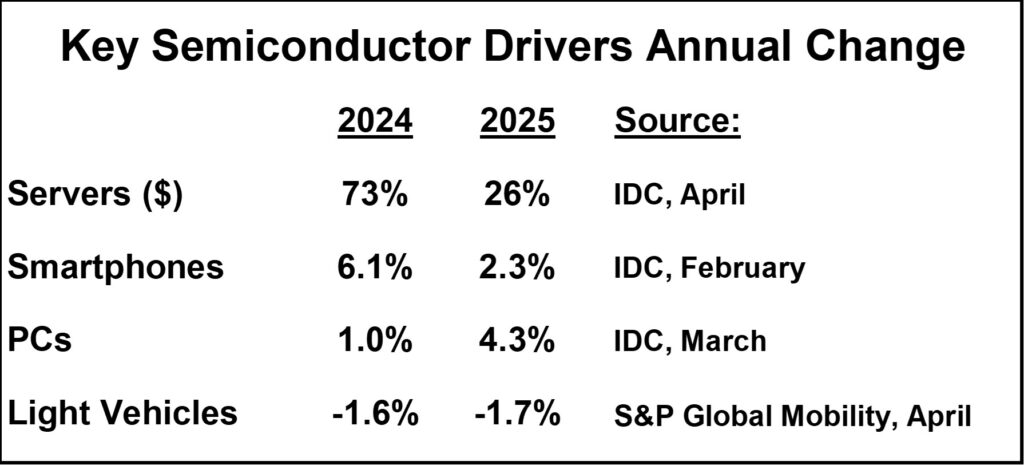

Key end equipment drivers of the semiconductor market are projected to slow in 2025 versus 2024. The server market was a major driver in 2024 with 73% growth in dollar value, according to IDC. 2025 is expected to show healthy growth, but at a much slower rate of 26% growth in dollars. IDC forecasts smartphone units will only grow 2.3% in 2025, down from 6.1% in 2024. PCs are the only major driver expected to show an increase in growth rate in 2025 at 4.3%, up from 1.0% in 2024, according to IDC. The end of support for Windows 10 and increased AI computing should drive PC growth despite tariff uncertainty. Worldwide production of light vehicles is projected to see a decline of 1.7% in 2025 following a 1.6% decline in 2024, according to S&P Global Mobility. Again, tariffs were cited as the major reason for the decline.

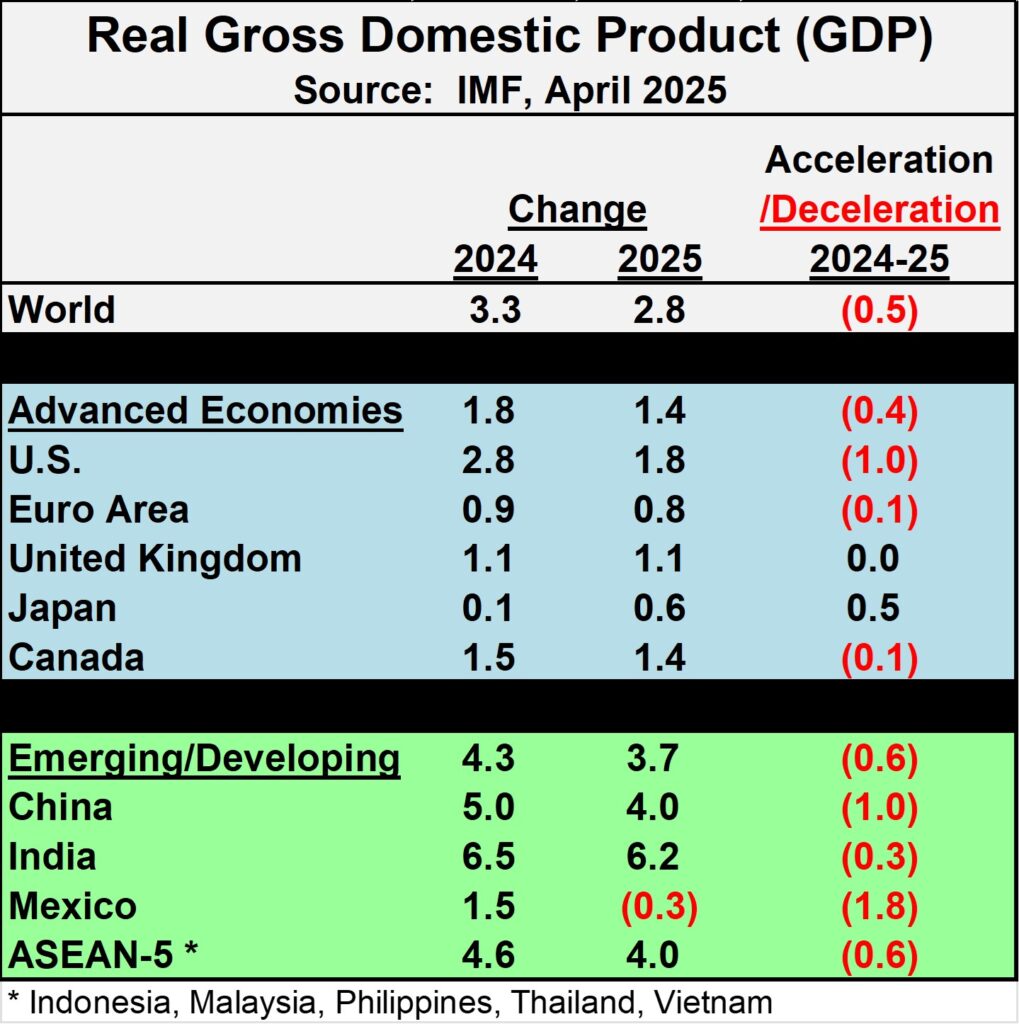

The International Monetary Fund (IMF) reduced its outlook for global GDP in April. The IMF cited the uncertainty around tariffs as the primary reason for the reduction. The IMF excepts World GDP growth to decelerate by half of a percentage point from 3.3% in 2024 to 2.8% in 2025. Both advanced economies and emerging/developing economies will see an overall slowing of growth. The biggest growth deceleration in terms of percentage point change is expected in the U.S. (down 1.0), China (down 1.0) and Mexico (down 1.8).

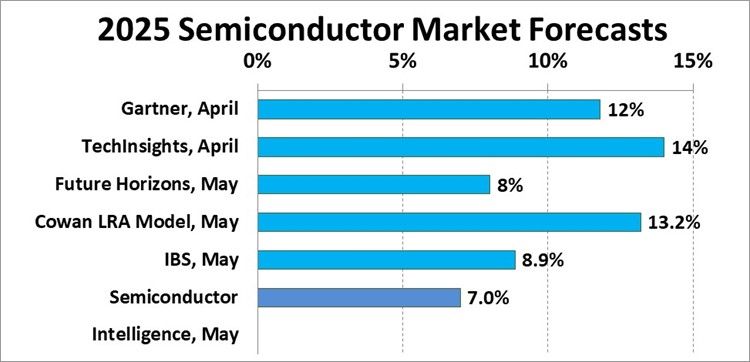

Recent forecasts for global semiconductor market growth in 2025 range from our 7% at Semiconductor Intelligence to 14% at TechInsights. Although TechInsights has the highest forecast, they project a moderate tariff impact would lower growth to 8% and a severe tariff impact would lower it to 2%.

Our 7% forecast for 2025 is primarily based on the uncertainty about tariffs. Tariffs may not affect semiconductors directly but could have a significant impact on key drivers such as automotive and smartphones. The weakness in the semiconductor market could carry into 2026, resulting in low single-digit growth.